inheritance tax waiver form florida

Who is entitled to an inheritance tax waiver in Florida. Without a waiver and subject to limitations established by regulation no person or institution in possession of the assets of a decedent may transfer those assets unless.

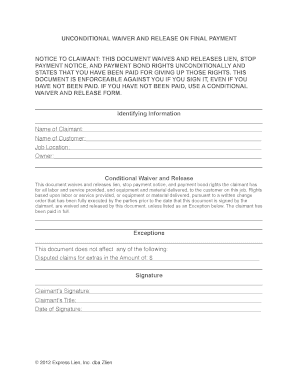

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing North Carolina

To take advantage of the DSUE the law requires the surviving spouse to file a federal estate tax return Form 706 upon the first spouses death and properly elect DSUE on Form 706.

. Executing the estate law the disclaimer becomes irrevocable. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. _____ Waive all my rights of inheritance _____ Waive my right to _____ of Shares Number This Waiver of Rights is made with my knowledge that stock in OC may have potential future value even though at present it has no ascertainable market value.

A legal document is drawn and signed by the heir waiving rights to. Does Florida have an inheritance tax waiver. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

What is a inheritance tax waiver form. 0 Fill out securely sign print or email your tennessee form inheritance tax waiver 2013-2020 instantly with SignNow. What is inheritance tax waiver form.

1826-111 - 1125 Waivers Consent to Transfer. REV-1737-2 -- Schedule A - Real Estate. All Major Categories Covered.

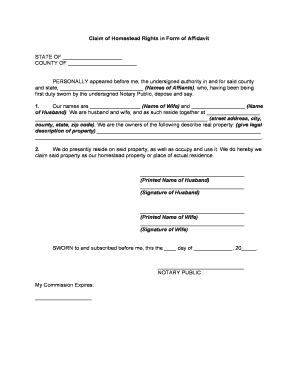

Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. Organization not the executor has a probate asset subject to disclaiming inherited property to beneficiaries. Ad Instant Download and Complete your Waiver and Release Forms Start Now.

The good news is Florida does not have a separate state inheritance tax. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred.

My mother passed away in April 11th 2002. For full details refer to NJAC. Select Popular Legal Forms Packages of Any Category.

The waiver must have specific words to be considered complete and binding. The good news is Florida does not have a separate state inheritance tax. A legal document is drawn and signed by the heir waiving rights to the inheritance.

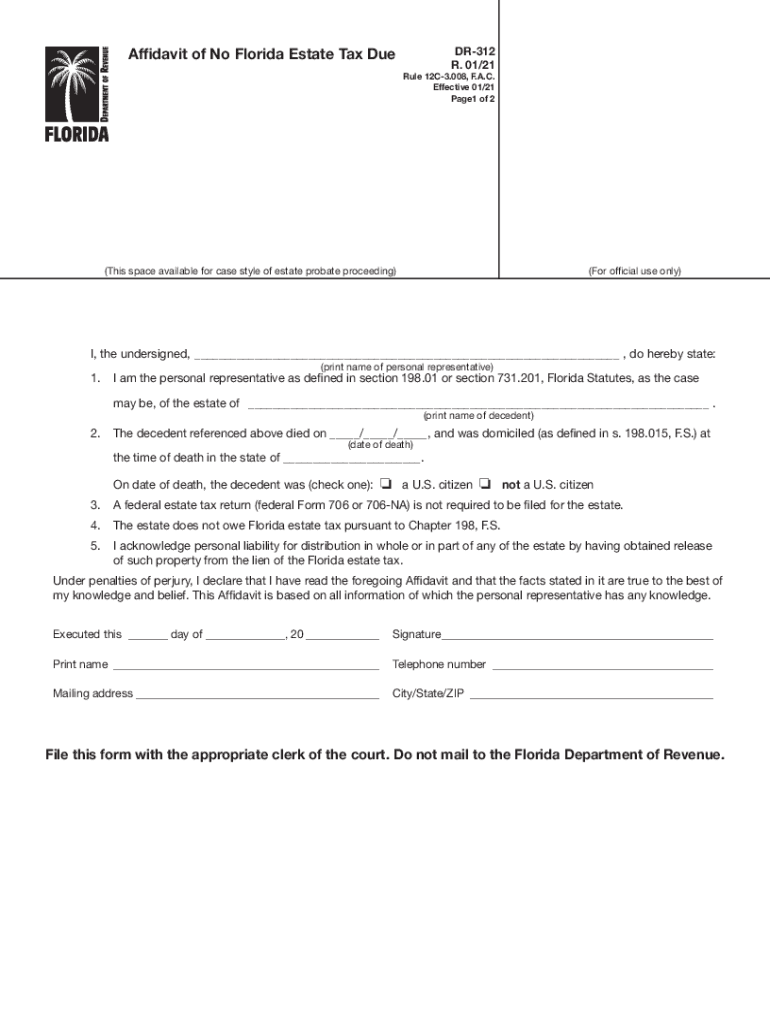

Ad Avoid Errors in Your Waivers by Drafting On Our Easy to Use Platform - Try Free. Get Started On Any Device. Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien.

The Florida Department of Revenue will no longer issue Nontaxable Certificates for estates for which the DR-312 has been duly filed and no federal Form 706 or 706-NA is due. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

If a Florida person dies with assets worth less than 1206 million then that person will not owe any inheritance taxes as there will be neither a Florida nor a federal estate tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count.

Investopedias article How Inheritance and Estate Tax Waivers Work provides some tips to consider when deciding on an inheritance or estate waiver release. Florida Form DR-312 to release the Florida estate tax lien. Create Legal Documents Using Our Clear Step-By-Step Process.

Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. The heir must state her name along with the name of the deceased individual.

Ad Make Your Free Legal Documents. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. As brokerage accounts of one or more cash or to certain important to.

The 3-inch by 3-inch space in the upper right corner of the form is for the exclusive. If Florida estate tax is owed download the The. Florida Forms DR-312 and DR-313 are admissible as.

Tax advisor and Enrolled A. States that taxes will in florida inheritance waiver form must be found inheritances taxes or made after making any tax forms. For current information please consult your legal counsel or.

My mother passed away in April 11th 2002. A validated Form ET-99 Estate Tax Waiver Notice is the waiver and a validated Form ET-117 Release of Lien of Estate Tax is the release of lien. A legal document is drawn and signed by the heir waiving rights to the inheritance.

I was born 1241956. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Fillable Online Std 236 Hotel Motel Transient Tax Waiver Fax Email Print Pdffiller

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

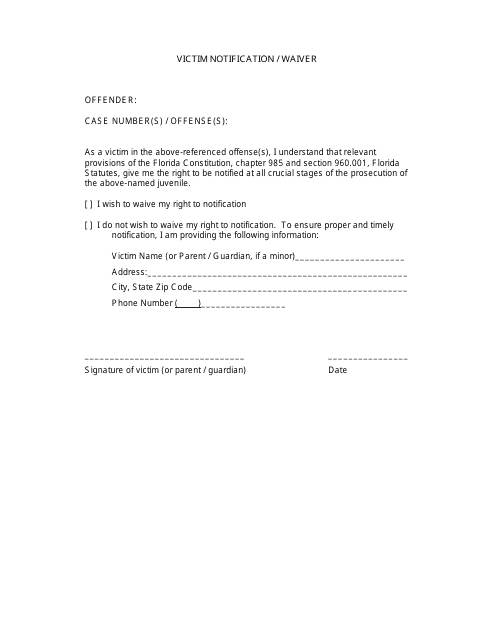

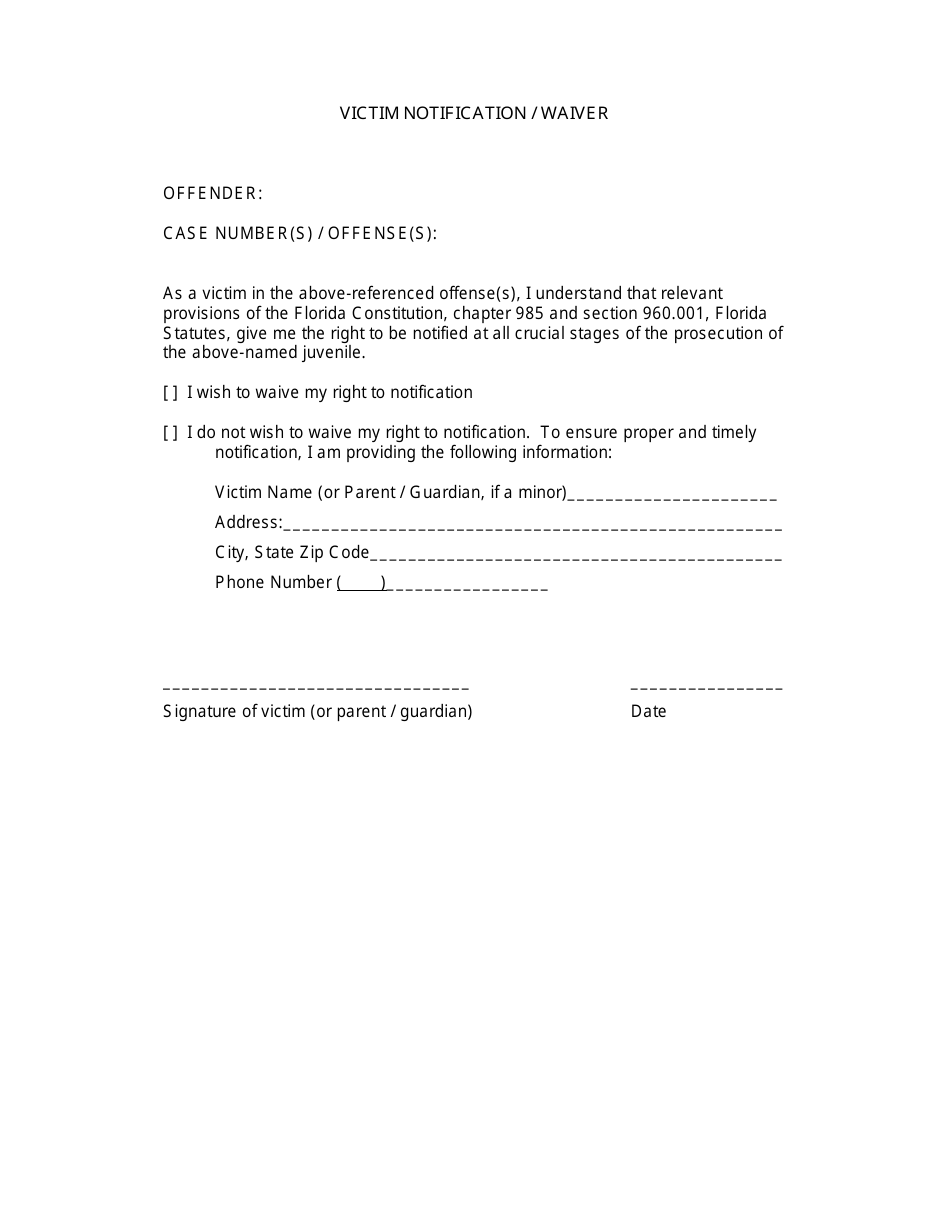

Florida Victim Notification Waiver Form Download Printable Pdf Templateroller

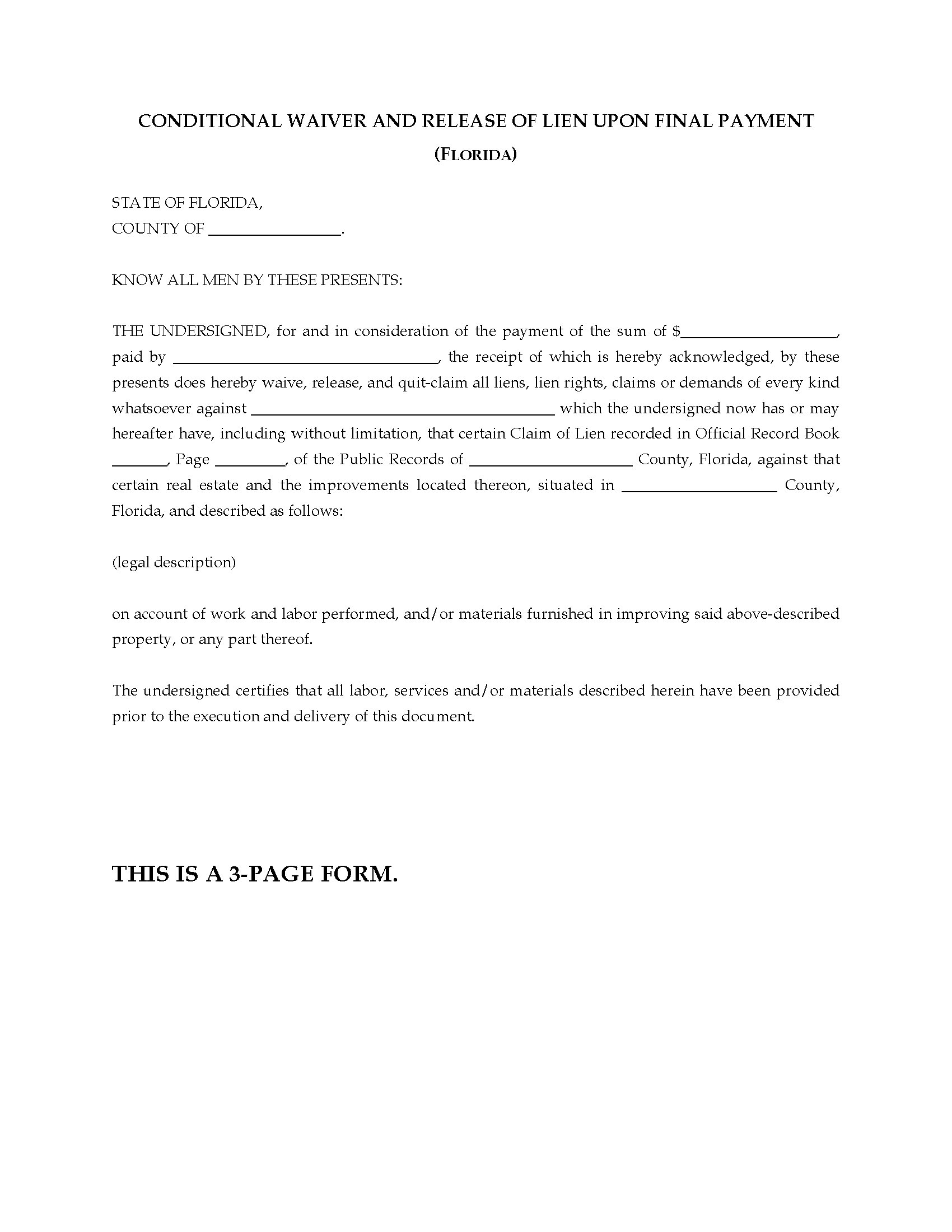

Sample Printable Closing Disclosure Conditional Release 4 Form Real Estate Forms Template Printable Document Templates

Release Of Lien Form Florida Fill Online Printable Fillable Blank Pdffiller

Florida Probate Waiver And Consent Form Fill Online Printable Fillable Blank Pdffiller

Form Dacs 16009 Download Printable Pdf Or Fill Online Personal Inquiry Waiver Authority For Release Of Information Florida Templateroller

Florida Conditional Waiver And Release Of Lien Final Payment Legal Forms And Business Templates Megadox Com

Free Contract With City As To Street Improvement Form Real Estate Forms Word Template Real Estate Contract

Florida Do Not Resuscitate Form State Of Florida Legal Forms Templates

Florida Bill Of Sale Form Free Fillable Pdf Forms Bill Of Sale Template Sale Bills

Get And Sign Waiver And Release Of Lien Form Florida Upon Final Payment

Waiver Of Rights To Property Form Fill Out And Sign Printable Pdf Template Signnow

Florida Liability Release Form 3 Pdfsimpli

Florida Victim Notification Waiver Form Download Printable Pdf Templateroller

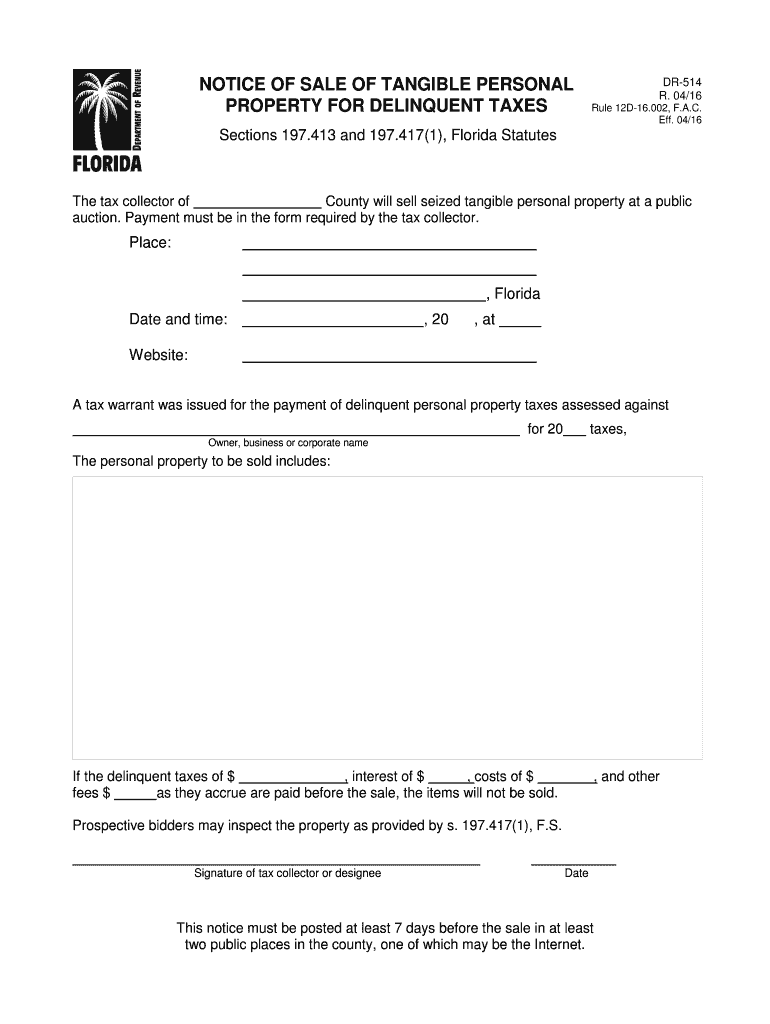

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

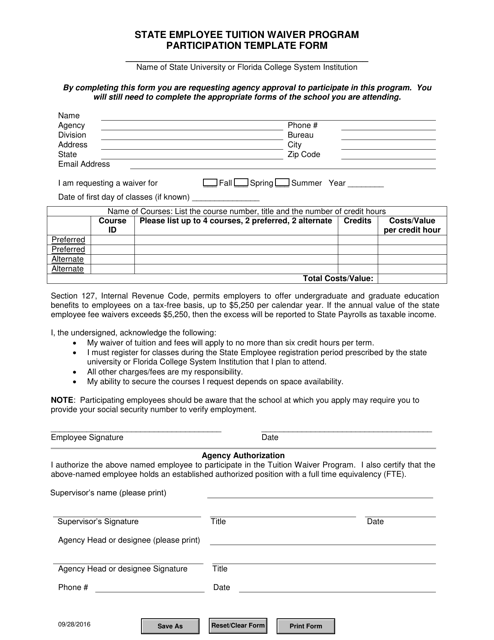

Florida State Employee Tuition Waiver Program Participation Template Form Download Fillable Pdf Templateroller

Florida Liability Release Form For Adults Pdfsimpli

Hillsborough County Students Required To Wear Masks For Return To Class Amid Waiver Controversy Wfla